Living

Should I sell or hold onto my rental property?

Doing the math reveals surprising numbers

Earlier this year, I wrote about the question of renting vs. buying a home in D.C. In this column, I’ll address the other side of that equation—leasing out vs. selling a property.

Earlier this year, I wrote about the question of renting vs. buying a home in D.C. In this column, I’ll address the other side of that equation—leasing out vs. selling a property.

Washington is a city with many small real estate investors holding one or two properties. Imagine that you’ve owned a rental town home for a while that has suffered from deferred maintenance, and that now needs an overall facelift to continue being rentable. You’re trying to decide whether to spend $100,000 on renovations or to sell the property as-is for its market value of $600,000. What should you do?

There is no absolute right or wrong answer to this question. Your decision will be informed by a number of factors:

• Your current financial situation—how much do you need the full amount right now? Are you using the property for current cash flow? Do you have all the money for renovation or will you refinance with a conventional loan to get a $100,000 cash out or will you wrap your existing loan into a 203k loan (with the renovation cost built in)?

• Your long-term financial situation—are you planning to use the property as part of your retirement, whether for cash flow or for a nest egg to sell?

• Your tax situation—Do you need the property as a tax shelter? If you sell now, will you do a 1031 exchange or will you have to pay capital gains?

• Your patience—Do you have the energy to manage a construction project (if only as the client of the general contractor) and all the many renovation design choices you will have to make?

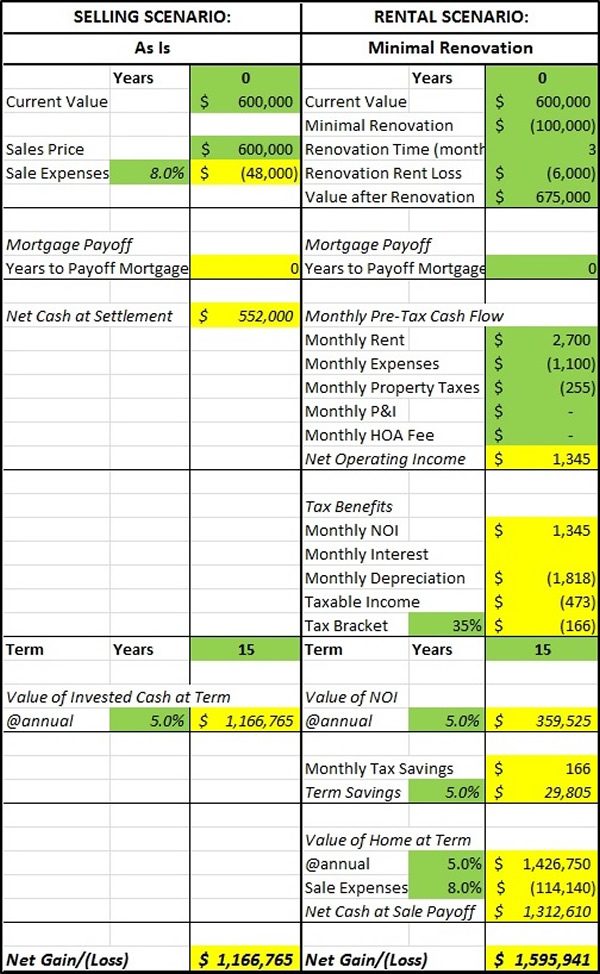

From a purely financial aspect, the numbers are clear that you will do better to lease and hold rather than to sell and invest (unless it’s in another rental property). Let’s take a look at the numbers for a 15-year comparison, based on the chart here.

First, let’s consider the sales scenario, which is quite simple: Let’s say you sell the town home for the current market value of $600,000. With 8 percent selling costs (6 percent for brokerage fees and 2 percent for other fees, including the city transfer tax), that would leave you with net cash at settlement of $552,000. If you invested that cash in a fund paying 5 percent, after 15 years you would have $1,166,765.

First, let’s consider the sales scenario, which is quite simple: Let’s say you sell the town home for the current market value of $600,000. With 8 percent selling costs (6 percent for brokerage fees and 2 percent for other fees, including the city transfer tax), that would leave you with net cash at settlement of $552,000. If you invested that cash in a fund paying 5 percent, after 15 years you would have $1,166,765.

Next, the rental scenario: For the sake of simplicity, let’s say you already own the town home outright and you have the ($100,000) cash needed for renovation. Doing the renovation will take three months, so that means (3 x $2000=$6000) in lost rental income, but your renovated town home will be worth $675,000, so let’s assume that you can now command $2700 in monthly rent for the renovated space. With monthly expenses and property taxes costing around ($1355), your monthly net operating income (NOI) is $1345. Let’s say that your monthly depreciation on your property is ($1818), which subtracted from your NOI gives ($473) in monthly taxable income. For a 35 percent tax bracket, that translates into ($166) tax savings per month.

If you invest your $1345 monthly NOI (net income after operating expenses and property taxes) at a 5 percent rate of return, in 15 years you will have $359,525. Over the same period, you will have saved $29,805 in income tax. At that point, your rental property should have appreciated in market value to $1,426,750, assuming an average 5 percent increase per year. (For Washington as a whole, average sale prices have appreciated 6.4 percent over the last six years from December 2009 to December 2015.) In order to end up with a cash-to-cash comparison, let’s say you sell the town home for market value at this 15-year point. With 8 percent selling expenses, that would leave you with $1,312,610. Adding together the 15-year value of the net operating income, tax savings, and net cash from the town home sale—and then subtracting the renovation cost and lost rental income during renovation—you would realize a net gain of $1,595,941.

In this comparison, leasing and holding yields a 36.7 percent improvement over selling and investing. But remember, your circumstances may not be the same as those assumed in these scenarios. Your best option is to consult your tax adviser, as well as a Realtor knowledgeable in investment properties.

Happy hunting!

Ted Smith is a licensed Realtor with Real Living | at Home specializing in mid-city D.C. Reach him at [email protected] and follow him on Facebook, YouTube or @TedSmithSellsDC. You can also join him on monthly tours of mid-city neighborhood open houses, as well as monthly seminars geared toward first-time homebuyers. Sign up at meetup.com.

Real Estate

In real estate, trust the process

With rates coming down, we could see spring surge in buyers

The average 30-year mortgage rate is falling, little by slowly. With predictions that the rate will continue to adjust downward in the next year or two, there may be a busier spring market than we have seen in the last few year, especially for the DMV market, which has been reeling from thousands of layoffs this past year. The frenzied activity resulting from interest rates close to 3% for some borrowers will probably not occur; however, this spring could add up to be a few notches busier than the last.

What does this mean for buyers and sellers? Lender Tina Del Casale with Waterstone Mortgage says she has seen “low to mid 6’s as the average for conventional loans.” If rates continue downward into the 5% range, there may be more activity than we saw in the last year or two. This could release a little bit of pent up demand.

Many buyers will have found that for whatever reason, their current home is not meeting their needs. Sellers may want to finally take the plunge and put a for sale sign in the yard and online, now that they might find a more reasonable rate on their next home. This winter can be an opportunity to assess financial situations, home conditions, and optimize one’s chances to have a sale with more agreeable terms, or put one’s best foot forward in an offer. In addition to checking with a lender or favorite handy person, let’s review what sellers and buyers typically spend their energy negotiating while enjoying the lovely process called “going under contract”:

- Timelines – Sellers might want to have their house solidly under contract (papers signed, thumbs up from the lenders, all inspection items decided upon and settled) so that they can put an offer down on a new home, and then negotiate that timeline with the other sellers. Remember, making a move is not only about the buyer taking possession of a new home, but also about the sellers figuring out their situation as well.

- Sale Price – unfortunately for buyers, in the eyes of most sellers, “money talks.” So, in a non-competitive situation, a seller might be happy to just get one offer at a price that was within the desired range. As soon as another interested buyer enters the equation, it can become a little bit like RuPaul’s Drag Race, and one will have to lip sync for one’s life, honey! And only one buyer will get to hear the words, “condragulations!”

- Tone/Vibes/Energy in the Room – Remember: Human beings are emotional creatures. All of us have feelings. And all of us want to put energy into situations where we feel appreciated, where a level of self-awareness exists, and a sense that each side is trying one’s hardest to act in good faith. The best transactions I saw were where a little grace was the “grease on the wheels” of the transaction. Occasionally, a buyer had cold feet and wanted to see the unit a few more times before the settlement date, or a seller forgot to scrub the bathroom with a little extra elbow grease before the settlement date. Life happens; misunderstandings can occur. A wise therapist once said: “You don’t have to like it, but can you allow it?” The tone of one or both parties in the transaction can be what seals the deal, or results in one party exiting the contract. (In the case of the dirty bathroom, the seller left a check with the title company for the buyer to pay a housekeeper to come clean what they couldn’t.)

Joseph Hudson is a referral agent with Metro Referrals. He can be reached at 703-587-0597 or [email protected].

Real Estate

Signs you’ve outgrown self-management of your D.C. rental

Keeping up with local regulations is a struggle

According to rental market statistics from RentCafe, Washington, D.C., remains at the top of the most popular cities for rental properties. With a strong rental market and a growing population, success should be second nature to real estate investors and rental property owners in this area.

As a self-manager of your own rental, if you’re not enjoying the profitability and the earnings that this market can provide, it might be time to look for professional management.

There are certain signs that show property owners have outgrown self-management. We’re exploring those today, and inviting DIY landlords to consider the benefits that come with a partnership with a professional property management company in Washington, D.C.

Washington, D.C., is known for having a complex and ever-changing regulatory environment. There are strict tenant rights, rent control laws, and specific rules related to property maintenance such as mold, lead based paint hazards, among others. The Rental Housing Act of 1985 is strictly enforced, and under this program, there are specific rules regarding rent adjustments, dispute resolution, and eviction protections.

Fair housing laws need complete compliance, security deposits have strict timelines, and habitability standards are in place to ensure tenants are living in a home that’s safe and well-maintained.

Staying on top of these rules can be time-consuming and difficult. Violating even a small regulation unintentionally can result in fines or legal action. It’s critical to stay compliant, and if you find yourself struggling to keep up with the evolving laws and regulations, it’s a clear sign that you may need professional help. Property managers can reduce the risk and liability of making a legal mistake.

Financial Returns are Underwhelming

A lot of self-managing landlords choose to lease, manage, and maintain their own properties because they don’t want to pay a management fee. We get it. Keeping more of your money seems like the best way to increase profitability.

But, here’s the reality of it: property managers can help you earn more and spend less on your investment, increasing your earnings and your ROI. In fact, a good property manager can often earn enough additional net revenue for the owner to pay for that fee over a year.

Property managers are experienced at maximizing the financial performance of rental properties. We can help:

- Optimize rental income

- Reduce vacancy rates

- Lower maintenance costs through established vendor relationships

- Recommend improvements for higher values

Ultimately, a good property manager will ensure that your property is being run efficiently. We will use our expertise to ensure your property is earning what it should.

Maintenance and Repairs Are Taking Up Too Much Time

Maintenance challenges are not unique to self-managing rental property owners. We deal with them, too, as professional property managers. We respond to plumbing issues and appliance malfunctions, we take calls in the middle of the night when a sewer is backing up, and we work hard to protect properties against deterioration and general wear and tear.

This can be overwhelming, especially when it comes to finding vendors and service professionals that are both affordable and provide quality service. Plumbers, electricians, HVAC technicians, and even landscapers and cleaners are in high demand in Washington, D.C. But maintenance at your rental property cannot wait. It’s essential to the value and condition of your investment as well as to the product you are selling.

It’s time to work with a professional property manager if you’re having trouble finding vendors or if you’re struggling to keep up with maintenance requests. We have systems for emergency responses, routine repairs, and preventative services.

Tenant Screening Is Becoming More Difficult and Time-Consuming

Finding good tenants is one of the most critical aspects of rental property management. But in our home of Washington, D.C. we have one of the most regulated rental markets in the country. The tenant screening process has become increasingly complex, highly restricted, and time-intensive.

Many property owners are surprised to learn that there are more limitations than ever on what can be screened, what information can be used in making a decision whom to rent to, and how screening decisions must be documented. Federal and local laws tightly regulate the use of credit histories, criminal background records, income verification, and even eviction records. Staying compliant is not optional. Failure to follow these rules can open the door to discrimination claims, administrative complaints, substantial fines, or even lawsuits.

That’s why rushing or relying on outdated methods can easily result in selecting the wrong resident or worse, unintentionally violating DC’s Human Rights Act or federal Fair Housing laws.

Problematic tenants often become evident only after move-in: lease breaks, chronic late payments, noise complaints, and property damage. When these patterns appear repeatedly, it is often a sign that the screening process is not sufficiently structured.

Why Professional Screening Matters

Professional property managers have systems in place to perform thorough, legally compliant screening while avoiding oversteps that could violate the regulations. Professional property managers use trusted screening platforms and follow written processes that keep owners protected and ensure fairness for applicants.

Columbia Property Management’s screening process includes:

- Credit Report Review

Evaluating credit patterns, payment reliability, and debt load while complying with restrictions on how data can be used. - Rental History Verification

Contacting prior landlords and reviewing national eviction databases—keeping in mind that some jurisdictions like the District of Columbia limit how far back eviction data can be seen, must less considered. - Background ChecksReviewing public records in a manner consistent with DC’s Human Rights Act and federal guidance on criminal history usage. Not all criminal records can be considered in rental decisions, and timing rules often apply.

- Income & Employment Verification

Confirming applicants can afford the rent and other monthly expenses based on their income, without ruling out certain income in a discriminatory way (e.g., vouchers, subsidies, or lawful alternative forms of income). There are many intentional steps conducted by professional property managers under a framework that ensures decisions are based on objective criteria, applied consistently, and fully aligned with the latest federal and DC regulations.

Your Property Is Sitting Vacant for Longer Periods

While current rental market dynamics are starting to show the effects of federal workforce layoffs and the worsening local economy, the vacancy rate in Washington, D.C., is relatively low, compared to the national average. According to a news report from WTOP, the local vacancy rate is just 6%, and there are an average of seven applications for every available rental unit.

A vacant rental property can quickly become a financial drain. Whether you own a condo near Dupont Circle or a single-family home in one of Capitol Hill’s neighborhoods, every day your property sits empty means lost income. While the D.C. market is generally competitive, the reality is that there are always fluctuations in demand based on seasons, neighborhood desirability, and even economic trends.

If you’re struggling to fill your rental quickly, it might be a sign that you need to re-evaluate your approach. An experienced property management company has a marketing strategy in place to keep vacancy periods as short as possible. From professional photos and listings to leveraging established networks, they can help ensure that your property is rented quickly, reducing the amount of time it sits vacant.

While managing a rental property in Washington, D.C., can be rewarding, it’s also challenging. As your property portfolio grows or the demands of your life or the demands of being a landlord increase, it’s helpful to recognize when it’s time to step back and let a professional handle the day-to-day tasks.

From navigating complex local regulations to ensuring your property remains occupied and well-maintained, there are many reasons why rental property owners in Washington, D.C., outgrow self-management. If any of these signs resonate with you, consider partnering with a property management company like ours to ensure that your rental investment continues to thrive without the stress and burnout of self-management.

We’d love to be your Washington, D.C., property management partner and resource. Please contact us at 888-857-6594 or ColumbiaPM.com

Scott Bloom is owner and Senior Property Manager, Columbia Property Management.

Advice

My federal worker husband is depressed and I don’t know how to help

I feel like he’s dragging me into his hopelessness

Dear Michael,

My husband is a federal worker. Many of his colleagues took “the fork” or have been fired. So work has been overwhelming. He usually works late. The morale in his office is terrible. His paycheck disappeared with the shutdown although due to the specifics of his job, he still had to go in. He’s gotten increasingly depressed, irritable, and short-tempered.

I met Jason 20 years ago when we were young, and one of the things that made me fall in love with him was his idealism. He came to Washington because he wanted to contribute to the well-being of our country.

When I look at him now, it’s like he’s been through the wringer. He’s lost his idealism, feels unappreciated by our country, and is becoming bitter.

He never wants to go out with friends. Either he doesn’t want to hear them complain about the same sorts of things he’s experiencing, or he doesn’t want to have to interact with people who are doing just fine, job-wise.

He also doesn’t feel like going out, just the two of us. So we’re home a lot. But we’re not spending time together when we’re at home. He’s surfing the internet, doom-scrolling, or playing video games.

I can’t get him to talk to me; he says, “I don’t want to talk about anything, it just makes me feel worse.” I can’t get him to do anything that might help him feel better. He doesn’t want to cook dinner with me, he doesn’t want to eat any of his favorite foods that I make for him, he won’t go for a walk with our dog (exercise is supposed to help mood, right?).

I’m really worried about him. Clearly, he’s depressed, and nothing I am trying is helping him to feel better.

But in addition, I am starting to get annoyed. How much more can I try to do things for him that he doesn’t respond to and doesn’t appreciate?

I’ve been OK through this long slog, so far, but now I feel like I am being sucked into his depression and hopelessness. I’m starting to feel like giving up. I’m lonely and I miss my husband and I am despairing that he’s ever really going to come back.

In short, now I hate my life, too.

I’m not going anywhere but I am worried that my main feeling toward him is starting to be apathy. Is there something I can do to help him that I haven’t thought of?

Michael replies:

I’m sorry, this is such a rough time.

It’s understandable that when someone you love is suffering and feeling miserable, you might at times get fed up and feel like pulling away.

There’s a great saying by an ancient Jewish sage, Rabbi Tarfon: While you can’t fix the whole world, that doesn’t mean you should give up and do nothing to help.

I thought of that saying as I read your letter, because while you can’t get Jason to change his mood or take action on his own behalf, you may have some ability to help him.

Similarly, while you can’t have a fantastic time in life when your husband is in a miserable place, you can take care of yourself and likely have a better life than you are having at present.

For starters, I encourage you to keep reminding yourself that this is without doubt one of the hardest periods of your husband’s life. So it’s a very good idea to have an open heart and a lot of compassion for Jason, as much of the time as you can. This won’t be easy. Strive to keep in mind that getting angry at Jason or frustrated with him won’t help.

Don’t try to insist that Jason do anything. Often, when we push someone to do something that they don’t want to do, this just results in their digging in more. People generally don’t like to be nagged.

Of course you can ask Jason if he’d like to join you for a walk, or an outing, but tread carefully. You can advocate for what you’d like, but Jason gets to decide what he wants to do.

You can certainly ask Jason what he would like from you, especially when he’s complaining. I love the “3 H’s” concept: Would he like you to hear (simply listen)? Would he like help (advice on what to do)? Or would he just like a hug?

The best message you can send to Jason, by your presence and by an ongoing loving stance, is “I am here. You’re not alone.” Even when he wants to stay in the basement playing video games. You’re not criticizing him and you’re not judging him. Maybe you’re baking some cookies you both like and leaving him a plateful to eat if and when he wants to. (Be sure to treat yourself to some, as well.)

In terms of bigger interventions, you can suggest that Jason meet with a therapist, or meet with his physician to discuss the possibility of an antidepressant to help him through this awful period. For example, you might have a sincere conversation where you say something like this:

“I’m worried about you. I really want to encourage you to get some help. My love for you can only go so far, and while I’m not going anywhere, I’d like you to take seriously how miserable you are. I’m here to encourage you that maybe you could feel better, even though your circumstances are terrible and you feel disillusioned.”

Again, trying to convince or force Jason to take action will likely go nowhere useful.

Now let’s focus on you. Living with a depressed spouse can be a miserable, soul-crushing experience. As you described, you’re watching the person you love suffer, and you’re pretty much losing your partner in so many of the things that make life enjoyable.

Part of getting through this is to acknowledge that there is a limit to what you can do for Jason. And part of it is to strengthen your commitment to self-care. Taking care of yourself may keep you from going too far into misery or resentment. He doesn’t want to get together with a friend? Consider going anyway, and do your best to have at least a good time. Same thing with a dog walk, a good meal, or sitting down to watch a movie you’d like to see. You might also consider meeting with a therapist for ongoing support and strategizing.

While this period of your life is gruelingly difficult, try to remember that it likely will come to an end, that there will likely be good times ahead for you and for Jason, and that in the meantime, doing your best to find ways to take care of yourself while also being a supportive and loving spouse will help you to survive.

Michael Radkowsky, Psy.D. is a licensed psychologist who works with couples and individuals in D.C. He can be found online at michaelradkowsky.com. All identifying information has been changed for reasons of confidentiality. Have a question? Send it to [email protected].